引言:组态屏产业格局的转变与汽车智能化趋势的融合,正共同推动中国组态屏面板产业的快速发展,这将带来对背光模块需求的持续增长,中国背光模块产业因此具备更大的发展潜力。

组态屏面板

组态屏面板背光模块由背光光源、光导板、光学膜及塑料外壳组成,是组态屏显示面板的重要组成部分。由于背光模块具有技术密集型和劳动密集型特点,凭借丰富的技术人才优势,中国正吸引组态屏产业加速向国内转移。

01、组态屏产能加速向中国转移,推动中国背光模块产业发展

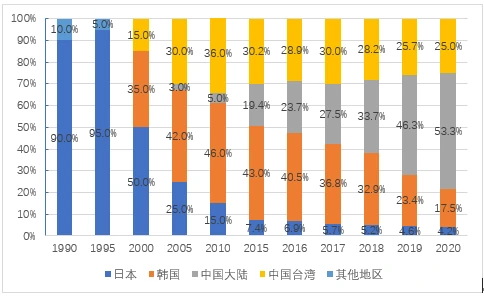

从液晶应用至今,组态屏产业产能转移经历了三个阶段:2000年日本主导全球液晶产业; 2000年至2010年,日本的生产能力转移至韩国和台湾;2010年至今,日本制造商逐步退出液晶面板行业,生产能力开始转移至中国大陆,目前中国大陆的液晶面板生产能力已占全球一半以上。

组态屏面板行业市场份额按国家划分

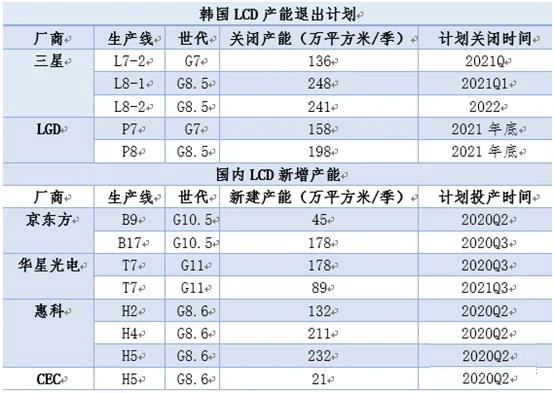

近年来,韩国的三星和LG显示将业务重点转向OLED,并将逐步关闭组态屏生产线并退出组态屏面板行业;在韩国制造商退出之际,国内企业正加快新建项目以扩大组态屏产能。

2020年至2021年,京东方、华星光电、华科、中电显示等企业共计8条第7代组态屏生产线建成投产,国内面板制造商还计划进一步扩产,未来几年国内组态屏产能将持续增长。

组态屏面板制造商倾向于选择邻近的配套模块供应商,以确保关键零部件供应链安全并降低成本。组态屏面板生产产能向中国转移将为国内背光模块制造商带来机遇,并推动国内背光模块产业的发展。

近年来,韩国组态屏生产产能退出计划与国内组态屏生产产能扩建计划

02、车载显示屏新兴,带来背光模块新需求

未来汽车将更加注重驾驶体验和智能化发展,这将带来对车载显示屏需求的持续增长。一方面,车载显示屏数量逐步增加,例如仪表盘、后视镜、中央控制平台等显示方式多样化,乘客及后排位置也配备娱乐显示屏。另一方面,汽车显示屏正朝着大屏化、多屏化方向发展,尤其在高端车型中,大屏已成为标配,例如特斯拉Model S的屏幕尺寸达17英寸,梅赛德斯-奔驰A级车型配备两块10.5英寸显示屏。

汽车显示屏

同时,中国对新车的需求巨大。尽管中国汽车销量已达2500万辆,但目前中国的人均汽车保有量仅为发达国家的四分之一,未来新车需求潜力依然巨大。因此,中国汽车显示屏市场增长潜力巨大,这将直接推动国内背光模块需求持续增长。

03、从市场发展趋势看,传统中型背光模块领域制造商更具发展优势

根据终端应用尺寸,背光模块可分为大、中、小三种规格,其中小型背光模块主要应用于智能手机、可穿戴设备等终端,中型应用于笔记本电脑、平板电脑、车载屏幕等终端,大型主要应用于液晶电视。

从市场竞争格局来看,国内背光模块企业已在细分领域深耕并形成各自竞争优势,包括宝明科技、龙利科技主要布局小型手机显示领域,汉博高科、威视电子主要布局汽车显示和笔记本电脑领域,瑞益光电在各领域均有布局。

从行业发展趋势来看,智能手机显示屏正向OLED转型,液晶电视市场逐渐饱和,未来大尺寸和小尺寸背光模块市场潜力相对较小;而车载显示市场潜力巨大,背光模块制造商普遍看好,目前正加速布局(见表2)。在传统中型背光模块领域,汉博高科和威士电子在核心技术专利、下游客户资源、工艺经验积累、生产成本等方面具有显著优势,未来发展潜力更大。

04、结论

当前组态屏产业正加速向中国转移,为中国背光模块产业带来发展机遇。此外,汽车智能化将持续推动中型车显示屏需求增长,率先布局中型背光模块领域的制造商凭借客户资源、核心技术、规模效益等优势将更具竞争优势。